Complete Beginners Guide On Terra Station Network

- Although new and small, Terra provides an innovative DeFi finance ecosystem and is one of the most efficient smart contract blockchains in the market.

- For users wanting to engage in the Terra ecosystem, first, they need to create an online account, download Terra Station, create a Terra wallet, and start funding their wallets with Luna tokens.

- The easiest way to purchase LUNA tokens is through a centralized exchange like FTX, Coinbase, and Phemex. Users then can withdraw the purchased tokens to their Terra Station Wallet address.

An Overview Of Terra

Built on Cosmos SDK, Terra is a scalable, programmable blockchain protocol that renders users a stablecoin ecosystem and provides stability when conducting cross-border payments. It was officially launched in January 2018 and released its mainnet in 2019.

Terra uses the Tendermint Delegated-Proof-of-Stake (DPoS) consensus mechanism to offer low-cost transactions with fast settlement speeds.

What makes Terra unique is its innovative and user-friendly protocols such as Mirror, a synthetic asset network, and Anchor protocol, a simple Protocol with predictable and steady gains.

Tera’s flagship product is its stablecoin called TerraUSD (UST). However, it heavily relies on its utility and staking coin, LUNA. Cross-chain interoperability also means more utility and higher demand.

Terra’s Stablecoin offers instant settlement, low fees, and seamless cross-border exchange for retail transactions.

Open an online account

To begin investing, you’ll first need to open an account with a crypto exchange that supports Luna. The two most prominent cryptocurrency exchanges in the US are Voyager and Gemini.

If you do not want to pay trading fees, you can go to ZenGo, a platform that lets users buy Terra Luna tokens for free!

Set up a Terra Wallet

To participate in the Terra ecosystem, you would first need to set up a wallet.

There are two kinds of crypto wallets, hardware and software wallets. Hardware wallets store your cryptocurrency offline and are physical devices, whereas software wallets are computer programs or mobile apps that store cryptocurrencies. Since it would be impossible to store your funds without a physical device, hardware wallets are the most secure way to store your cryptocurrency.

Although there are plenty of options available, experts believe that the Terra Station wallet, created by Terraform Labs, is the best choice. Available for mobile apps, browser extensions, an iOS application, and native windows, it is a non-custodial wallet.

Although it offers a similar user experience as that of MetaMask, it doesn’t provide various features like in-wallet token swaps or NFT support.

First, you would have to download Terra Station from its official website, then follow a few easy steps to create a new wallet.

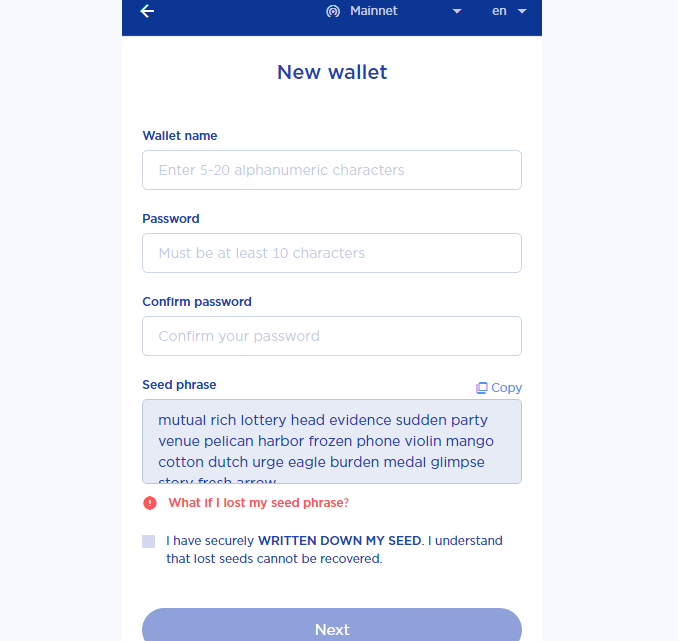

How To Create A Wallet:

- Open the Terra Station desktop app, select New wallet.

- Enter a secure wallet name and password.

- Confirm your password.

- Ensure you have written your seed phrase by checking the box and clicking Next.

- By typing or selecting the correct words in each prompt, confirm your seed phrase

- Click Create a wallet.

Also, it is very important to create a backup of your Seed Phrase and secure it somewhere safe because your seed phrase will give access to your private key to anyone, in turn giving access to your funds. You can use durable options such as titanium to secure your seed phrase backup.

Once you have created a wallet, as required, you will need to fund your wallet with LUNA tokens. LUNA is Terra’s native token used for governing, mining, and as a volatility absorption tool for Terra stablecoins, which are used for capturing rewards through transaction fees and seigniorage. It is essential to have LUNA in your wallet to pay transaction fees.

A convenient way to buy LUNA is through a centralized exchange such as Coinbase, Phemex, or FTX. After buying the tokens, the next step is to withdraw tokens to your Terra Station wallet address which can be easily found at the top of your wallet app or the browser extension.

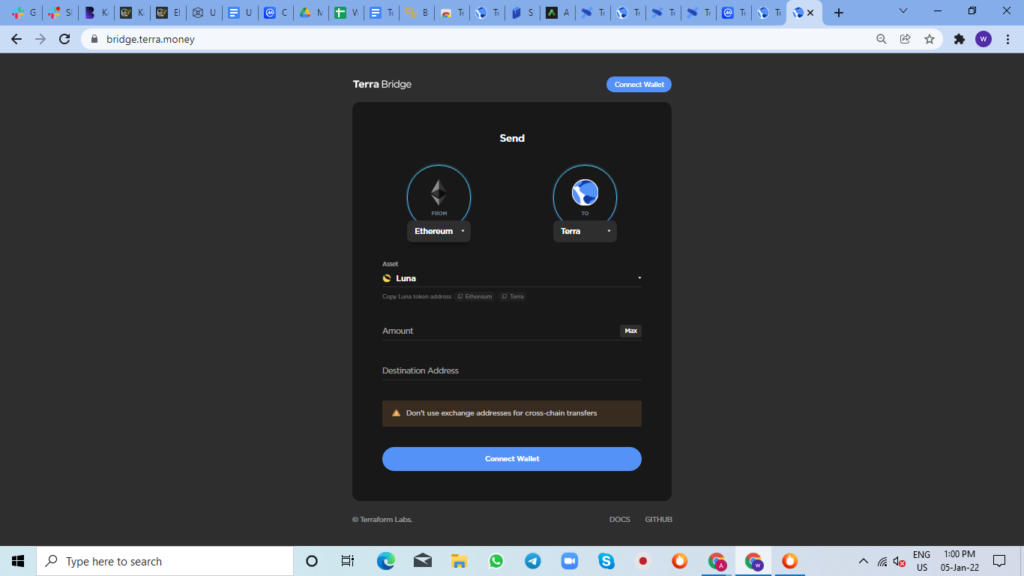

An alternative way for someone with Funds can be to buy LUNA is through Uniswap and then transfer it to the Terra Station wallet using the Terra Bridge.

Steps To Navigate The Terra Bridge:

- First, connect your Etheruem wallet to Terra Bridge.

- Then, on the left-hand side of the app, you will find the “from” dropdown menu; choose the Ethereum network in it.

- On the right-hand side, choose Terra.

- In the “asset” dropdown, select LUNA.

- Set the amount and paste your Terra Station wallet address into the “destination address.”

- Click Next.

After you have approved the transaction in your metamask, Terra Bridge will automatically swap wLUNA for LUNA and also deposit it in your wallet on the Terra Network.

Using the Wormhole Bridge, you can do the same process if you have funds on Solana.

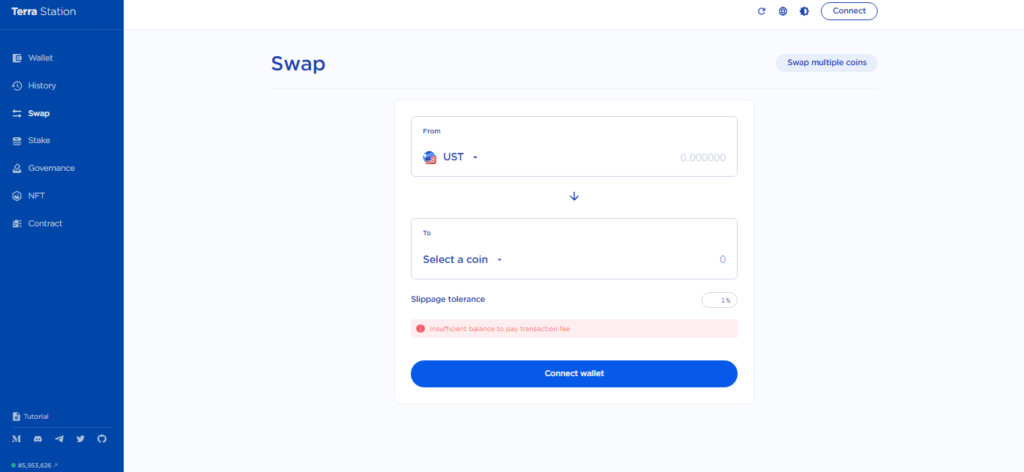

Steps To Swap coins

- After opening Terra Station, connect your wallet and click Swap.

- Go to the Swap coins section, Choose a coin and enter the amount you want to swap.

- Click on the coin you want to swap to.

- Click next and a new window will pop up.

- Confirm your transaction amounts and enter your password.

- Click Swap to complete your transaction.

A Whole Guide To Terra

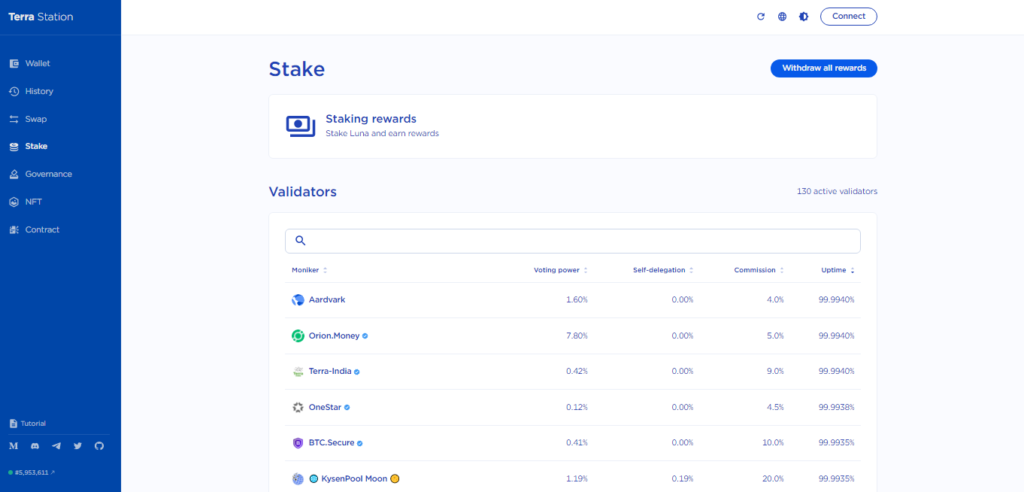

The next logical thing to do after creating a Terra Station wallet is to stake your LUNA purchase. Currently, Terra relies on 130 validators for verifying and clearing transactions. They also secure the network by running full nodes and committing new blocks to the blockchain.

Validators and Delegators earn a stable revenue stream from seigniorage and transaction fees in return for their service. Currently, the amount for delegators and validators is 7.07% and 7.47%, respectively.

For becoming a validator on Terra, users either be among the top 130 largest stakes or bond their LUNA tokens for at least 21 days. This makes way for everyone to put their LUNA tokens to work either by staking or delegating them to validators, which in turn will share the particular portion of the revenue with their delegators.

How To Stake LUNA:

- Navigate to Terra Station and click Staking.

- Choose a Validator and Click on their name in the Moniker column of the validator list.

- Click Delegate in My delegations section, click Delegate. A new window will appear.

- Specify the amount of Luna you want to delegate in the Amount field, and click Next.

For delegating LUNA, go to Terra Station and from on the left side of the page, select “Staking” in the menu. A new dashboard will pop up showing a list of available validators; click on the validator’s name.

After selecting the validator of your choice, another dashboard will appear, where when you click on the “delegate” button, you’ll be able to delegate your LUNA.

Once you are done with all these steps: the bonded LUNA (bLUNA) will automatically accrue yield. To earn even more yield, you can use your bLUNA tokens on the Anchor protocol by purchasing UST.

Anchor pays you with its native ANC token for borrowing UST, and even for earning a fixed interest rate of 19.49%, the UST would be deposited on the same protocol.

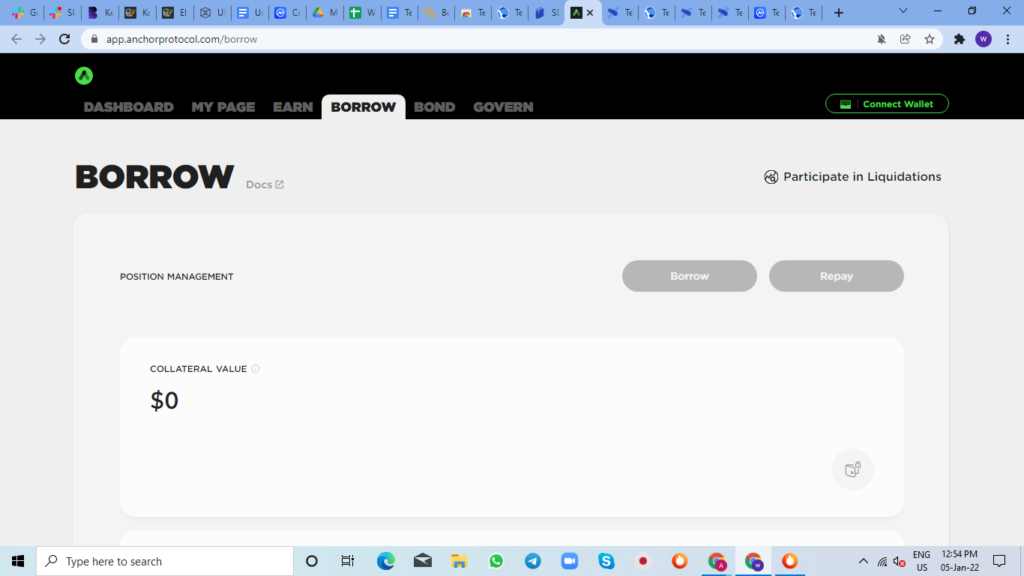

Borrow Or Lend On Anchor

To borrow or lend on Anchor is quite simple:

- Go to the “borrow” page of the app.

- Click on the “borrow” button.

- Set your desired loan-to-value ratio.

- Deposit your bLUNA collateral.

After following these steps, you’ll have UST in your wallet that can be used for anything you want, such as providing liquidity on Mirror or investing in synthetic stocks, purchasing other Terra-native tokens on TerraSwap, or farming on Spectrum Protocol.

What’s Next For The Terra Ecosystem?

However, still new in the industry and developing, Terra gives its competitors tough competition in the market. Terra’s stablecoin has gained quite a popularity in the market; according to the coinmarketcap, it is the fourth largest stablecoin in the market.

Terra has lots of potentials to grow into a global DeFi and stablecoin payment system; it saves users around 1.5% on transactions with its payment processor called Chai.

Anchor and Mirror Protocols are the two major forces behind Terra’s success and have become strong to give competition to robust DeFi systems in the market. Terra also gained its breakout in 2021 when it reached above $100 for the first time. According to the coinmarketcap, Terra is the 9th largest cryptocurrency in the market.

In conclusion, Terra has positioned itself such that it will experience only more adoptions in the future and continue to climb upward in its growth trajectory.

$10.5 Million Put by Golf Startup in NFT Sales

- Golf is the newest sport to surrender to the attraction of the non-fungible tokens and decentralization round by the virtue of LinksDAO.

- NFTs of LinksDAO are not golf clubs membership cards but the keys to the community accessibility, regulation, and various perks.

- Asset ownership will not be transferred by the NFT of LinksDAO, but the right to regulate it.

Golf Surrendered to NFTs

No area of the economy is hidden from the eyes of NFTs or tokenization. Golf is the new entry in the list of the ones getting lured by the non-fungible tokens and a decentralization round with the virtue of the LinksDAO.

$10.5 Million were piled up by the LinksDAO for funding its aspirations of golf. Over 9000 “global membership” and “leisure membership” were sold on the NFT behemoth OpenSea, in exchange for Ethereum.

It may appear that 2021 was a striving year for the DAO acts, with a surge of over 40000% in some treasuries, golf is now entering the course of crypto adoption.

However, in opposition to bored ape images or the presidential campaign fundraisers, LinksDAO is contributing to run a DAO, which would “ better the transparency regarding particular aspects of organizational control of the business of the club.”

NFTs are Not Membership Cards

The NFTs of LinksDAO is not the golf club’s membership cards but are key to community accessibility, various perks, and control. Membership will be unlocked by the Non Fungible Tokens for the LinkDAO’s initial leisure and golf club.

As it was expected, the sales of NFTs are just the freshly formed startup’s medium of teeing off. “Identification of the golf course’s list for acquiring them” is the principal objective of the LinksDAO strategy of the business, as well as the development of the crypto token $Links, which are expected to land in the middle of the year.

Mike Dudas is leading the group, a famous personality in the crypto world and an articulated anti-bitcoin maximalist. The title of the individual’s Twitter account is Mike DAOdas.

In spite of the buoyancy for the DAOs in the common market, some Non Fungible Token collectors and golf enthusiasts were left bamboozled regarding the path of Dudas for initiating a golfing organization through the creation of a DAO.

On a social media platform, Dudas clarified that the asset’s ownership would not be transferred, but the regulation rights will be provided over the club designing process and the capability of buying the club membership after its opening.

Comments

Post a Comment